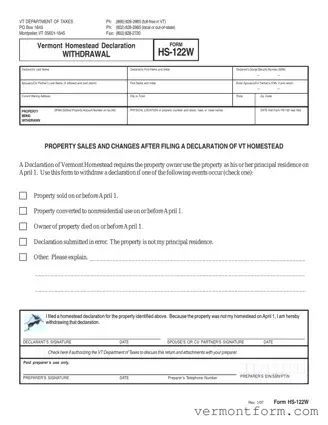

The HS-122W form, provided by the Vermont Department of Taxes, serves as a crucial procedural document for withdrawing a previously filed Vermont Homestead Declaration. Essentially, it caters to property owners who, due to various circumstances such as sale of the...

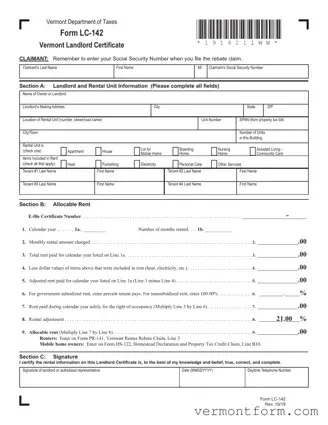

The VT Landlord’s Certificate Form LC-142 plays a pivotal role for Vermont renters and property owners, facilitating claims for renter rebates or property tax adjustments. Designed to be attached to either the Renter Rebate Claim or the Property Tax Adjustment...

The S-1 Vermont form, facilitated by the Corporations Division of the Vermont Secretary of State's office, is the cornerstone for entrepreneurs either starting a new business in Vermont or seeking to register a foreign entity to operate within the state....

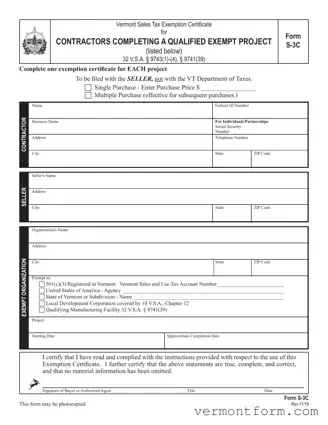

The Form S-3C serves as a Vermont Sales Tax Exemption Certificate specifically designed for contractors engaged in qualified exempt projects. It outlines the necessary criteria and documentation for exemptions under the statutes 32 V.S.A. § 9743(1)-(4), § 9741(39), allowing certain...

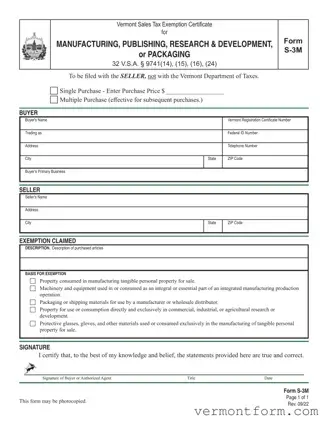

The S-3M Vermont form serves as a Sales Tax Exemption Certificate for various sectors including manufacturing, publishing, research & development, and packaging within Vermont, as defined by 32 V.S.A. §9741(14), (15), (16), (24). Designed to be submitted to the seller...

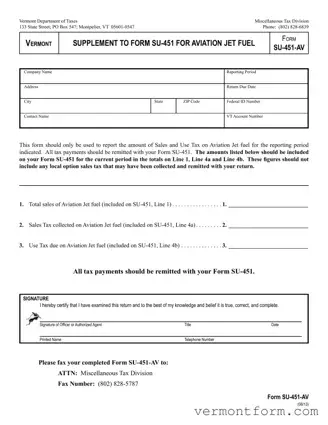

The Form SU-451-AV is a critical document for businesses dealing with the sale of Aviation Jet Fuel in Vermont. It serves as a supplement to the main Form SU-451, exclusively focusing on reporting Sales and Use Tax related to Aviation...

The Vermont Directive for Health Care form empowers individuals to dictate their healthcare decisions through a legal document. It allows the designation of an agent to make healthcare decisions on one's behalf if they are unable to do so and...

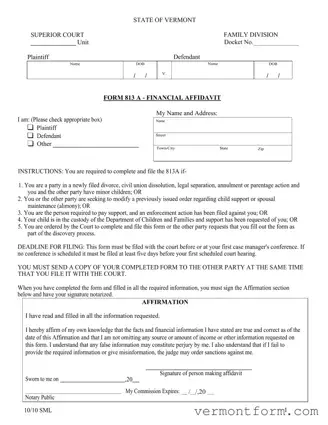

The Vermont 813 form, officially termed as the Financial Affidavit, plays a crucial role within the legal frame of family court proceedings in Vermont. This document is required from parties involved in a variety of family law cases, including divorce,...

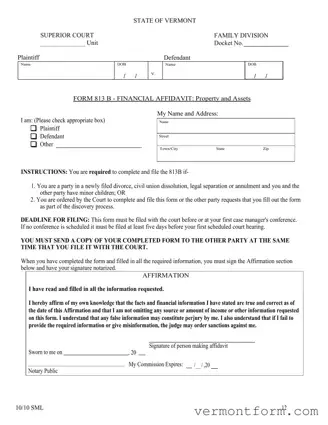

The Vermont 813B form, formally known as the Financial Affidavit: Property and Assets, is a critical document for individuals undergoing divorce, civil union dissolution, legal separation, or annulment proceedings in the State of Vermont, especially when minor children are involved....

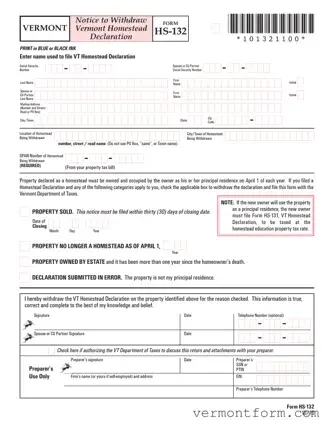

The Vermont HS-132 form, officially known as the Notice to Withdraw Vermont Homestead Declaration, is a critical document for homeowners needing to update their homestead status with the Vermont Department of Taxes. Primarily, this form serves to inform the state...

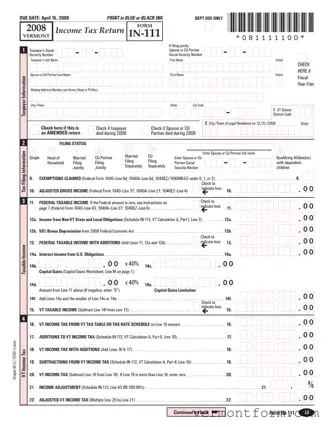

The Vermont Form IN-111 is the state's income tax return document for the tax year 2008, requiring completion and submission by April 15, 2009. It mandates taxpayers to staple their W-2 or 1099 forms and offers options for filing statuses...

The Vermont IN 152 form is a crucial document for individuals who may have underpaid their estimated tax in 2014. It provides a structured way to calculate underpayment, interest, and penalties, ensuring taxpayers can determine what they owe the state....