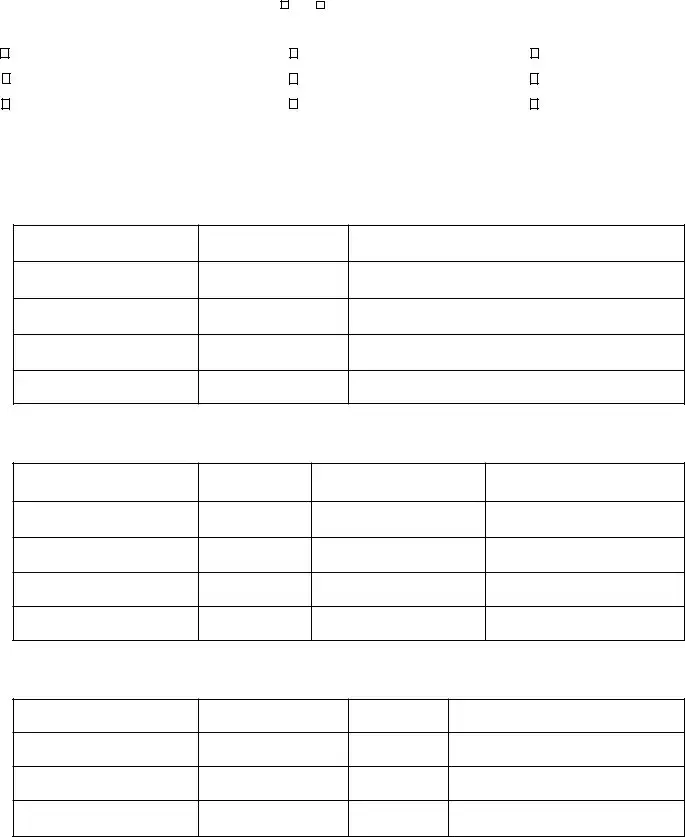

The Vermont 813 form shares similarities with the Financial Declaration Form used in other states for divorce or child support proceedings. Both documents require the individual to disclose comprehensive information about their income, including salary from employment, self-employment income, and other sources such as rental income, unemployment benefits, and social security benefits. This thorough detailing helps ensure fair financial assessments are made for alimony or child support determinations.

Comparable to the Income and Expense Declaration form in family law cases, the Vermont 813 form necessitates a detailed accounting of monthly expenses. Such expenses include health insurance costs, child care expenses, and any extraordinary expenses related to the children of the relationship. By juxtaposing income against expenses, these forms play a crucial role in evaluating financial needs and capabilities within legal proceedings, ensuring that any support ordered reflects actual living costs and needs.

Similar to Child Support Worksheets available in many jurisdictions, the Vermont 813 form involves an intricate breakdown of financial responsibilities towards minor children, including those from other relationships. Both types of documents are integral in calculating child support obligations, ensuring that all the children's needs are met adequately according to the parent's ability to pay.

The Vermont 813 form echoes the characteristics of the Affidavit of Financial Information used in some locations for spousal maintenance (alimony) cases. In these documents, individuals must disclose all sources of income and expenses, painting a full picture of their financial situation to aid the court in determining an appropriate alimony amount that is fair and equitable.

Like many Court Financial Statements that parties must file in family law cases, the Vermont 813 form includes sections for detailing public benefits received such as Medicaid, food stamps, and housing assistance. This information is essential for a comprehensive assessment of the party’s financial status, ensuring that support orders consider all facets of an individual’s economic life.

Similar to the Discovery Forms used in the pre-trial phase of divorce proceedings, the Vermont 813 form can be requested by one party from the other as part of the discovery process. This allows both parties to have a full understanding of each other's financial circumstances, fostering a fair negotiation process for dividing assets, and determining support obligations.

Comparable to Loan and Debt Schedules often attached to financial declaration forms, the Vermont 813 form requires detailed listings of all debts and liabilities, including mortgages, vehicle loans, and credit card debts. This comprehensive financial disclosure ensures that decisions regarding the division of debts and assets take into account all aspects of the parties’ financial realities.

Resembling Parenting Plan forms that detail expenses related to the upbringing of children, the Vermont 813 form’s sections on child care costs and extraordinary expenses for children highlight the financial aspects of parenting responsibilities. Both documents are critical in family law to ensure that financial support adequately covers the children's needs based on the parents' financial ability.

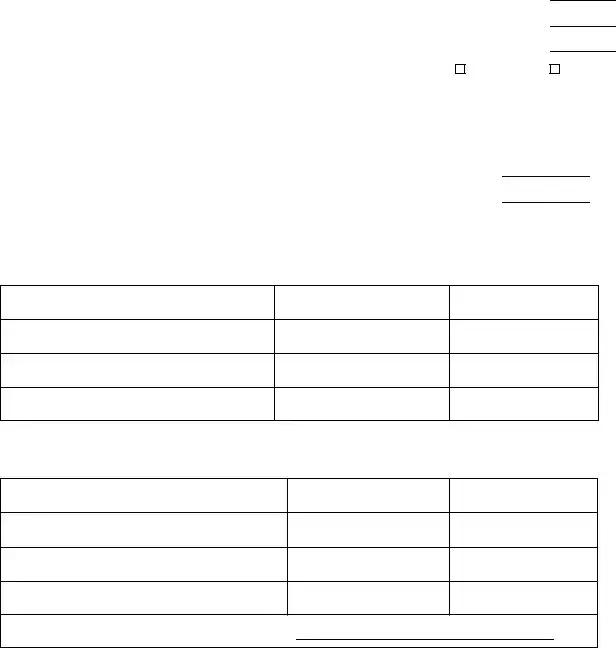

Plaintiff

Plaintiff

Defendant

Defendant

Other

Other

Yes

Yes